Prices Go Up, Life Goes On

The Eternal Shadow of Inflation Sweeps Onward

Best to impart the bad news first and then put it behind us, as we soldier on toward new vistas. Everything we need seems to be getting more expensive. Oh dear – you haven’t noticed? Then you must be the only creature on God’s not-so-green-anymore Earth to be blissfully unaware of this reality. So, as the man says, “Stick ‘em up!” We’re raising the prices of your delightful brew and delicious food.

FIRST PRICE RISE AT THE BISTRO IN FOUR FULL YEARS, FOLKS

Better to charge more for our fare than to even think of lowering the quality of ingredients and offerings. New items on the Menu and new prices for your grub’n’grog at Ya Udah Bistro coming soon. So if you are planning that rip-roaring knock-down-and-drag-out festival for your accounting staff, better do it now while the old price schedule is in force …

We are, in our defense, in tune with what’s going down in the Republic of Indonesia: life is not only getting scarier (Corny-19! Boo!) but pricier as well. Wages go up along with prices, fuel, rent – the whole shot. The last price increase at the Bistro was in October 2016. The world has moved along quickly since then.

Prices and wages have shot up. Official Government figures on inflation and increases in the prices of staples are only to be trusted if you also believe in the Tooth Fairy, Easter Bunny and Sundel Bolong.

LEAVE ME ALONE. I’M EATING.

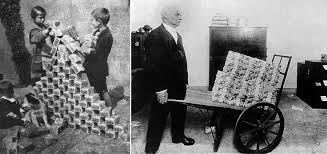

Life in Indonesia is special, in so many ways. But its inhabitants are not immune to the economic crises currently shaking the world. Remember your History lesson at school, about inflation in 1920s Weimar Germany?

Money was like play money. It would take a wheelbarrow’s worth to buy a loaf of bread.

As a matter of fact, our homeland / host country of Indonesia has had its own frequent flirtation with hyperinflation – for instance, in the zany final years of Sukarno’s reign, where the hapless inhabitants of Jakarta would have to line up for hours to buy a couple of kilos of uncooked white rice. You could have a full meal for – brace yourself – one Rupiah. But that was only because it was actually 1000, and the Government knocked off three zeros. Surprise! You’re rich again!

At the time, Indonesia had been locked in a struggle with runaway inflation, caused in part by the rapid expansion of its post-independence government sector. In the six years leading up to 1959, prices had tripled, prompting the central bank, under intense pressure from Sukarno, to devalue the rupiah by 75 per cent against the US dollar (500- and 1,000-rupiah notes later dropped 90 per cent). Even that move was not enough, and by the time of Subandrio’s warning to the Chinese ambassador inflation was at 38 per cent, problematic territory in anyone’s books though it would later reach the nosebleed level of 594 per cent in 1965.

Most recently there was the Asian Financial Crisis of 1997 ~ 1998 when the Rupiah went into a death spiral, zooming downward from Rp 2,500 / USD 1.00 to Rp 17,000 / USD 1.00 in a matter of weeks. From over 300 banks (many of them actually conglomerate-armed “piggy banks”) only around 20 wobbly survivors came through. Bank Mandiri was nicknamed the “Frankenstein bank” because it was cobbled together from a merger of four dead state banks. It was the end of the Suharto-era, as the global economic-nannies of the IMF and World Bank decreed major restructuring of the economy, in exchange for saving the Republic from bankruptcy. Wags renamed Reformasi as Repot Nasi (“trouble finding rice”).

Prices of locally-produced staples like tomatoes, eggs, stabilized, more or less, for some time. We do after all live on Java, whose rich volcanic soils yield opulent harvests of vegetables and grains, with several harvests possible each year.

Then why does our honored Ya Udah Bistro clientele pay such steep prices for their eats? Answer: You’re not just paying us, sweetie – you’re paying the government, whose exorbitant import duties on foods, both raw and processed would not be found in any western country. What if we told you that in the agricultural sector, tariffs on more than 1,300 products have bindings at or above 40 percent.

Now take these murphys, excuse me, spuds, sorry again, ‘taters. Potatoes are potatoes, right? No, not really. And some dishes are much tastier with imported varieties not grown in these tropical islands. But why do we have to pay a 50% import duty on fresh potatoes?? Indonesia is pleading with the E.U. to open up more to its commodity exports – primarily palm oil, which is saddled with a sensitive environmental rap as well. It should consider revising its own steep barriers to imports – food in particular.

What’s more, there is an incredible maze of bureaucratic twists and turns to pass through, as your documents trickle slowly through this Ministry and that one. What to do to expedite your shipment? Sleazy-looking guy with sneery smile gets in your face: “Ahh! I have a friend in Customs who can speed up your shipment of fresh cherries! Otherwise they might spoil, as your papers are not accurate…” [Rubs fingers together, in universal money-sign…]

Yep, we’re looking at baksheesh: Customs and corruption go hand in hand …

As for the tragic news – naw, nothing really tragic. No sticker shock. Just be prepared to shell out a bit more for your fine Euro-Asian cuisine and foamy firewater. Speaking of which, the big scandal is the import duty on alcoholic beverages, which averages 150%!! It’s a “sin-tax”, but one which benefits the Government… If it makes you sad then just have another and drink your sorrows away. A glass of table wine – patriotic red & white or lovely rosé – is still cheaper than anywhere else in town.

INFLATION IS FASCINATING – AS LONG AS IT DOESN’T HIT YOU IN THE BALANCE

What is the meaning of money? At first glance one might well object “An absurd question. Money is money!” but those in the know – the bankers, the economists, the wealthy scurrying across the globe to hide their billions in obscure watering holes like the Bahamas or the Isle of Man or Hong Kong – they are well-aware of the philosophical depth of this rhetorical question, and yes, the objective of this arch essay is to slip it to you …

Welcome to Zimbabwe, one of the new freedom-loving (if despotic) African republics, having thrown off the mean yoke of colonial conquest and exploitation (as stable, prosperous Rhodesia), moving forth into the 21st Century as a shining example of energetic capitalist inflation gone wild.

At the turn of 2006, Zimbabwe was experiencing a dramatic situation characterised by annual hyperinflation, four out of five adults unemployed, empty shops, frequent food and energy shortages while life expectancy had plummeted to 36.

Inflation for the single month of March 2007 was about 2,200%, meaning if one deposited their March salary in a bank account, its value would have been divided by 22 the following month. In August 2007, two litres of cooking oil cost 400,000 Zimbabwean dollars or about USD 2.80.

In January 2008, the annual inflation rate reached a record 100,580%, while the unemployment rate approached 80%.

The Zimbabwean dollar had lost so much of its value that exchanges were most often conducted in South African Rand, Botswana Pula or the US Dollar.

A few months later, during the month of July 2008, the annual inflation rate reached 231 million percent, threatening the country with bankruptcy.

Faced with the most unprecedented inflation in human history and the failure of all the options, the use of the US dollar was imposed at the start of 2009 to take advantage of the relative stability of the North American currency.

It’s a fine case study of “Just what happens when ‘money’ is simply what you say ‘money’ is” as the world looks on somberly.

Along with other out-of-control economies… like that of Venezuela …

A 2.4 kilogram chicken cost 14,600,000 bolívares ($2.22)

before Venezuela slashed five zeros from its currency.

Well just in case you get the notion that this kind of mismanagement of an economy is a recent phenomenon, I shall disabuse you with a bit of history, courtesy of Wikipedia:

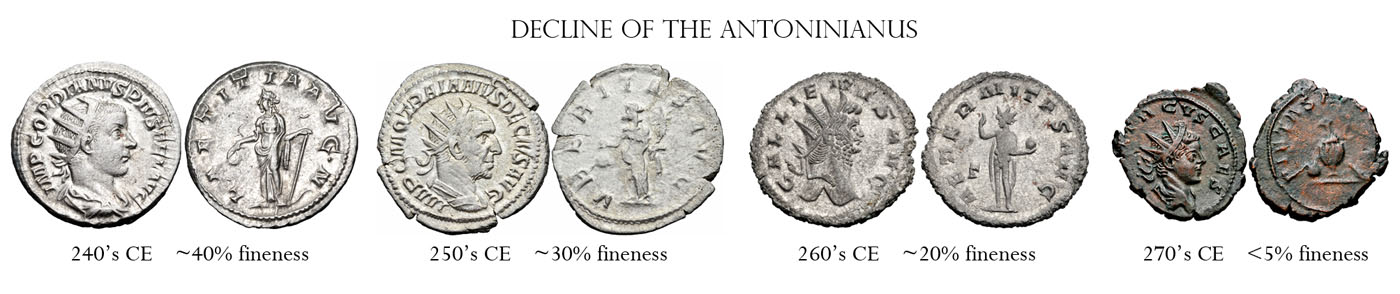

Historically, rapid increases in the quantity of money or in the overall money supply have occurred in many different societies throughout history, changing with different forms of money used. For instance, when silver was used as currency, the government could collect silver coins, melt them down, mix them with other metals such as copper or lead and reissue them at the same nominal value, a process known as debasement.

At the ascent of Nero as Roman emperor in AD 54, the denarius contained more than 90% silver, but by the 270s hardly any silver was left. By diluting the silver with other metals, the government could issue more coins without increasing the amount of silver used to make them. When the cost of each coin is lowered in this way, the government profits from an increase in seigniorage. This practice would increase the money supply but at the same time the relative value of each coin would be lowered. As the relative value of the coins becomes lower, consumers would need to give more coins in exchange for the same goods and services as before. These goods and services would experience a price increase as the value of each coin is reduced.

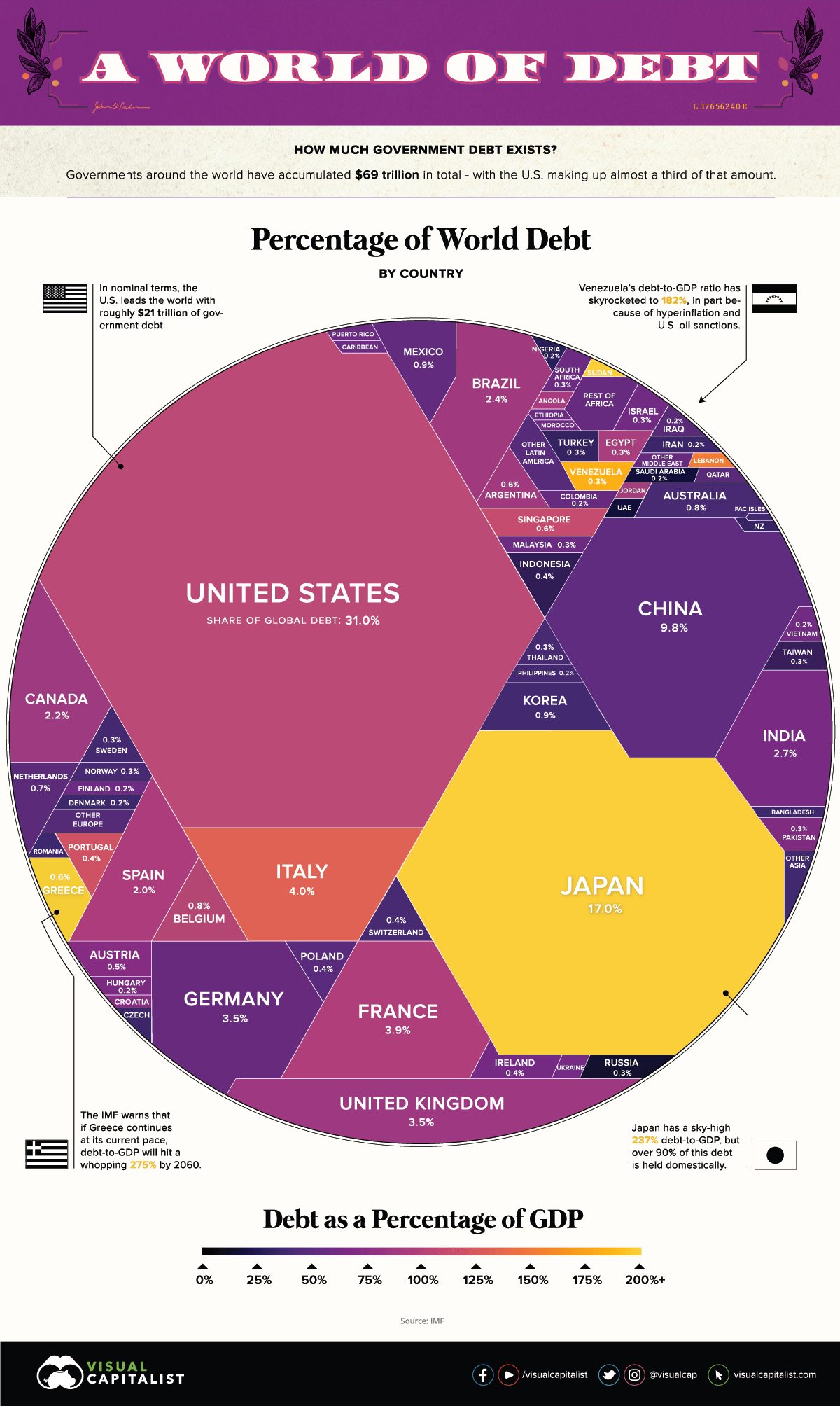

Today’s “debasement”, particularly in the so-called “advanced countries”, is much more technologically elegant: billions of Dollars, Euros, Yen, whatever are created by magic, conjured up on the computers of central banks. What’s backing up all that printed money – errh, sorry! It’s not even printedanymore! It’s just magically manufactured, out of thin air, with the hope nobody comes around with a couple of trillion and asks for gold or silver or any old-fashioned collateral.

Enjoy the ride (as planet Earth approaches a quadrillion dollars – yes that’s correct, an astronomical number – in debt overhang) until it all comes crashing down.

And isn’t it something that those crooks on Wall Street and The City (London) and Tokyo and Brussels can scold a third-world country like Indonesia for alleged “fiscal recklessness”…

Hey, Management is working hard on the new menu and list of new prices, with apologies for the extra bite, as we continue to serve a distinguished, discerning clientele, with excellent hygiene, fresh ingredients, “New Normal” cleanliness (waitresses and customers masked like for a Grand Ball, frequent sterilization with antiseptics of all surfaces, except for customer surfaces – we leave those alone).

So see you soon at the Bistro, a grand landmark of Menteng Jakarta for two decades, and now with a snazzy new outlet in Serpong.